Given the success of 400ZR pluggable coherent solutions in the market, discussions in the telecom…

Given the success of 400ZR pluggable coherent solutions in the market, discussions in the telecom sector about a future beyond 400G pluggables have often focused on 800G solutions and 800ZR. However, there is also increasing excitement about “downscaling” to 100G coherent products for applications in the network edge. The industry is labeling these pluggables as 100ZR.

A recently released Heavy Reading survey revealed that over 75% of operators surveyed believe that 100G coherent pluggable optics will be used extensively in their edge and access evolution strategy. In response to this interest from operators, several vendors are keenly jumping on board the 100ZR train by announcing their development projects: Acacia, Coherent/ADVA, Marvell/InnoLight, and Marvell/OE Solutions.

This growing interest and use cases for 100ZR are also changing how industry analysts view the potential of the 100ZR market. Last February, Cignal AI released a report on 100ZR which stated that the viability of new low-power solutions in the QSFP28 form factor enabled use cases in access networks, thus doubling the size of their 100ZR shipment forecasts.

“The access market needs a simple, pluggable, low-cost upgrade to the 10G DWDM optics that it has been using for years. 100ZR is that upgrade. As access networks migrate from 1G solutions to 10G solutions, 100ZR will be a critical enabling technology.”

Scott Wilkinson, Lead Analyst for Optical Components at Cignal AI.

The 100ZR market can expand even further, however. Access networks are heavily price-conscious, and the lower prices of 100ZR pluggables become, the more widely they will be adopted. Reaching such a goal requires a vibrant 100ZR ecosystem with multiple suppliers that can provide lasers, digital signal processors (DSPs), and full transceiver solutions that address the access market’s needs and price targets.

The Constraints of Power in the Access

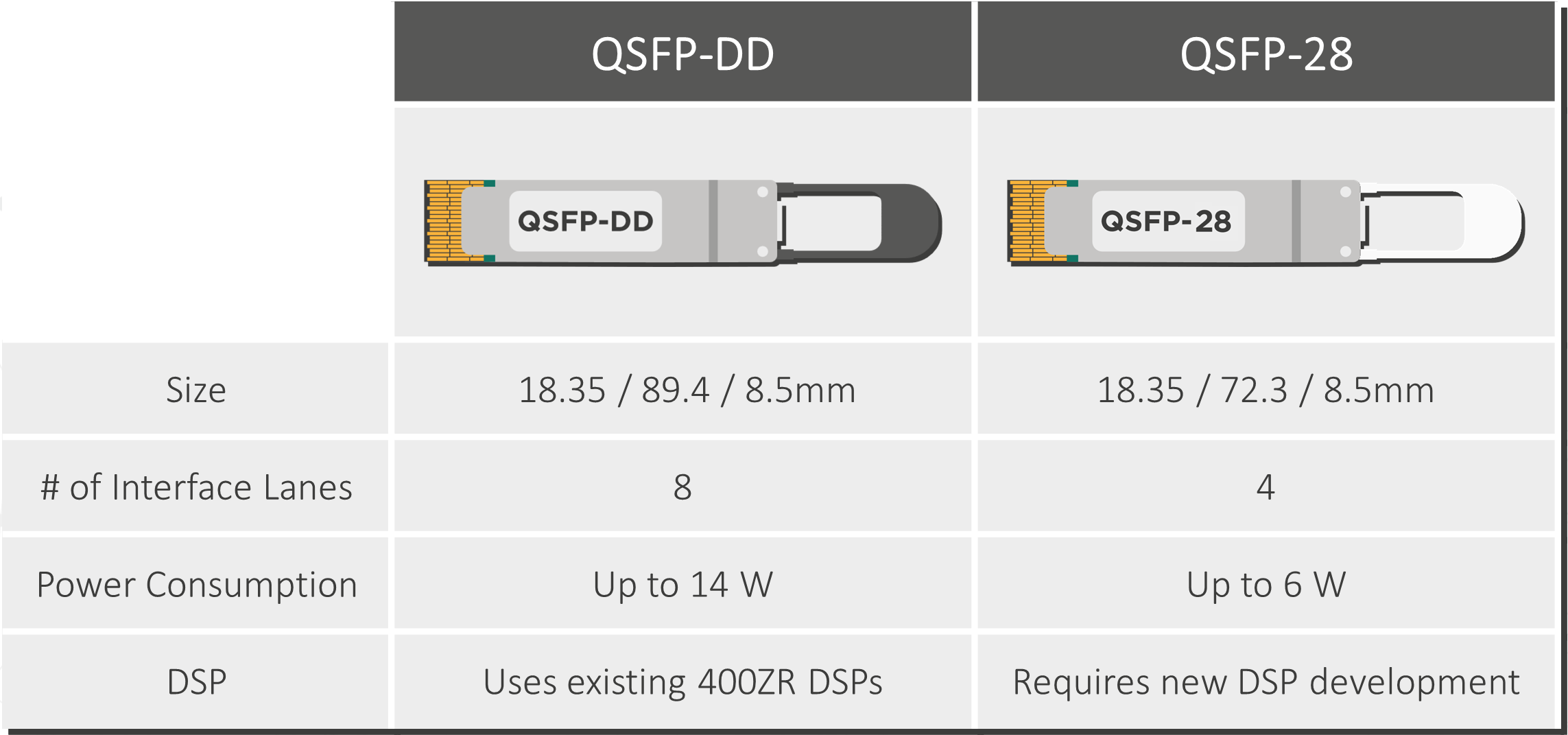

Initially, 100G coherent solutions were focused on the QSFP-DD form factor that was popularized by 400ZR solutions. However, power consumption has prevented these QSFP-DD solutions from becoming more viable in the access network domain.

Unlike data centers and the network core, access network equipment lives in uncontrolled environments with limited cooling capabilities. Therefore, every extra watt of pluggable power consumption will impact how vendors and operators design their cabinets and equipment. QSFP-DD modules forced operators and equipment vendors to use larger cooling components (heatsinks and fans), meaning that each module would need more space to cool appropriately. The increased need for cabinet real estate makes these modules more costly to deploy in the access domain.

These struggles are a major reason why QSFP28 form factor solutions are becoming increasingly attractive in the 100ZR domain. Their power consumption (up to 6 watts) is lower than that of QSFP-DD form factors (up to 14 Watts), which allows them to be stacked more densely in access network equipment rooms. Besides, QSFP28 modules are compatible with existing access network equipment, which often features QSFP28 slots.

Ecosystems to Overcome the Laser and DSP Bottlenecks

Even though QSFP28 modules are better at addressing the power concerns of the access domain, some obstacles prevent their wider availability.

Since QSFP28 pluggables have a lower power consumption and slightly smaller footprint requirements, they also need new laser and DSP solutions. The industry cannot simply incorporate the same lasers and DSPs used for 400ZR devices. This is why EFFECT Photonics has announced its plans to develop a pico tunable laser assembly (pTLA) and co-develop a 100G DSP that will best fit 100ZR solutions in the QSFP28 form factor.

However, a 100ZR industry with only one or two laser and DSP suppliers will struggle to scale up and make these solutions more widely accessible. The 400ZR market provides a good example of the benefits of a vibrant ecosystem. Four vendors are currently shipping DSPs for 400ZR solutions, and even more companies have announced plans to develop DSPs. This larger vendor ecosystem will help 400ZR production scale up in volume and satisfy a rapidly growing market.

While the 100ZR market is smaller than the 400ZR one, its ecosystem must follow its example and expand to enable new use cases and further increase the market size.

Standards and Interoperability Make 100ZR More Widespread

Another reason 400ZR solutions became so widespread is their standardization and interoperability. Previously, the 400G space was more fragmented, and pluggables from different vendors could not operate with each other, forcing operators to use a single vendor for their entire network deployment.

Eventually, datacom and telecom providers approached their suppliers and the Optical Internetworking Forum (OIF) about the need to develop an interoperable 400G coherent solution that addressed their needs. These discussions and technology development led the OIF to publish the 400ZR implementation agreement in 2020. This standardization and interoperability effort enabled the explosive growth of the 400G market.

100ZR solutions must follow a similar path to reach a larger market. If telecom and datacom operators want more widespread and affordable 100ZR solutions, more of them will have to join the push for 100ZR standardization and interoperability. This includes standards not just for the power consumption and line interfaces but also for management and control interfaces, enabling more widespread use of remote provisioning and diagnostics. These efforts will make 100ZR devices easier to implement across access networks.

Takeaways

The demand from access network operators for 100ZR solutions is there, but it has yet to fully materialize in the industry forecasts because, right now, there is not enough supply of viable 100ZR solutions that can address their targets. So in a way, further growth of the 100ZR market is a self-fulfilled prophecy: the more suppliers and operators support 100ZR, the easier it is to scale up the supply and meet the price and power targets of access networks, expanding the potential market. Instead of one or two vendors fighting for control of a smaller 100ZR pie, having multiple vendors and standardization efforts will increase the supply, significantly increasing the size of the pie and benefiting everyone’s bottom line.

Therefore, EFFECT Photonics believes in the vision of a 100ZR ecosystem where multiple vendors can provide affordable laser, DSP, and complete transceiver solutions tailored to network edge use cases. Meanwhile, if network operators push towards greater standardization and interoperability, 100ZR solutions can become even more widespread and easy to use.

Tags: 100ZR, access networks, DSP, ecosystem, edge, laser, market, price, solutions