Scaling up and down with coherent pluggable optics

Key findings from Heavy Reading's 2023 Coherent Optics Market Leadership Program show that coherent pluggable optics have been a resounding industry success, but operators will continue to need new variants to meet their needs.

Following the commercialization of 400ZR and 400G ZR+, coherent pluggable innovation is moving in two new directions: scaling up to 800G data rates while scaling down to 100G. As network operators expand their appetite for coherent pluggables, they continue to require new variants to meet their needs.

Heavy Reading launched the first Coherent Optics Market Leadership Program in 2021 to investigate emerging opportunities and challenges in coherent optics, spurred by the advent of 400ZR optics. The most recent 2023 project was based on a global network operator survey conducted in November that attracted 88 qualified responses.

This is the final installment of three blogs highlighting the key findings from the 2023 survey project. It focuses on developments in 100G and 800G.

Scaling down to 100G

Interest in new small form factor 100G coherent optics at the service provider edge is strong. These new optics, which the industry labels 100ZR, are set to supplant the bulky CFP2-DCO 100G modules that have existed for many years. Key characteristics include QSFP28 form factors, roughly 5-watt power consumption for QSFP28 compatibility and temperature hardening for outdoor cabinet deployments. To meet performance and cost requirements, 100ZR optics require purpose-built DSPs, and such products are coming to market. Given the nature of the edge/access segment, the volume potential for 100ZR is high.

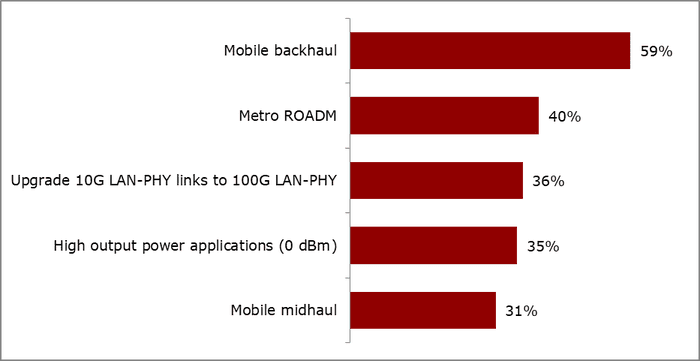

Selected by 59% of respondents, mobile backhaul is the primary application for coherent 100G by far. All other applications form a distant second tier and include metro ROADM, 10G LAN-PHY upgrades for enterprise services, longer-reach applications that require high output power and mobile midhaul. Comparing the data to the 2022 survey results shows that interest in mobile backhaul applications has risen sharply while interest in other applications — such as enterprise services — has remained steady.

Parsing the 2023 survey data further indicates that Tier 1 operators (defined as those generating $1bn or more in annual revenue) are especially keen to use coherent 100G pluggables for mobile backhaul. 70% of Tier 1 operators selected mobile backhaul, compared to 50% of their Tier 2/3 counterparts.

Which applications are most important for 100G coherent pluggable optics?

(Source: Heavy Reading, 2023)

Scaling up to 800G

High performance 800G optics were introduced commercially in 7nm DSPs, running at 90 Gbaud and embedded in line cards (as opposed to pluggable modules). The commercial introduction of 5nm DSPs boosted wavelength capacity to 1.2Tbps but allowed transmission at 800Gbps data rates over thousands of kilometers — widely opening the addressable market for high performance 800G. These new optics, based on 5nm DSPs, are also embedded in line cards.

Meanwhile, on a separate development track, the OIF 800G Coherent project is defining 800ZR coherent pluggable optics to be housed in QSFP-DD and OSFP form factors, much like 400ZR. The first 800ZR module demonstrations occurred at the European Conference on Optical Communication (ECOC) 2023 using 5nm DSPs, and Omdia forecasts general availability for coherent 800G pluggables starting in the second half of 2024.

As was the case with 400ZR, higher performance variants will also be required. Although there is currently no standardization track for high performance 800G pluggables, Heavy Reading refers to them generically as 800G ZR+.

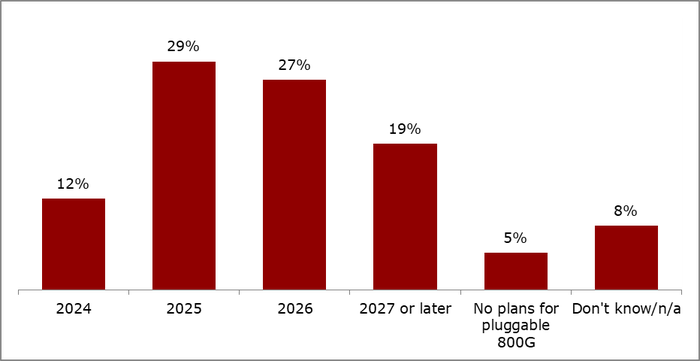

Heavy Reading survey data shows that some operators are ready to start buying 800G coherent pluggables optics as soon as they are available — with 12% of respondents expecting to deploy 800G coherent pluggables this year. The data indicates that 2025 and 2026 will be pivotal years for 800G coherent pluggable adoption, with 56% of respondents expecting deployment over these two years. An additional 19% expect adoption in 2027 or later while just 5% have no plans.

When will you deploy 800G coherent pluggable optics in your network?

(Source: Heavy Reading, 2023)

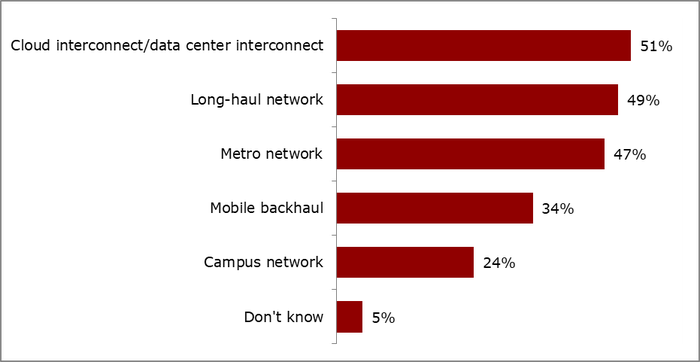

Unsurprisingly, applications planned for coherent 800G are very different from those for coherent 100G (and more in line with 400G). Survey data shows that DCI is the biggest application driver for coherent 800G, selected by just over half of the respondents. This application would be addressed by OIF 800ZR standardized optics. Interestingly, however, operators view long-haul networks as one of the biggest opportunities for 800G coherent pluggables. Long-distance applications will require high performance coherent 800G pluggables of the ZR+ variety, like what we have witnessed with developments of 400ZR and 400G ZR+.

What applications will drive the deployment of coherent 800G pluggables into your network?

(Source: Heavy Reading, 2023)

Starting with 400ZR, coherent pluggable optics have been a resounding industry success — with both hyperscalers and, more recently, telecom operators. Since demand for new applications is increasing, the industry seeks to replicate the 400G success story at both 100G and 800G (and in the future, 1.6T).

For more information on this topic and the Heavy Reading survey, check out this archived Light Reading webinar: Coherent Pluggable Optics: The Next Frontier.

About the Author(s)

You May Also Like